Indicators on Tax Accountant In Vancouver, Bc You Need To Know

Wiki Article

The smart Trick of Pivot Advantage Accounting And Advisory Inc. In Vancouver That Nobody is Talking About

Table of ContentsThe Buzz on Tax Consultant VancouverTax Consultant Vancouver for DummiesThe Only Guide for Virtual Cfo In VancouverTop Guidelines Of Virtual Cfo In VancouverThe Pivot Advantage Accounting And Advisory Inc. In Vancouver IdeasSmall Business Accounting Service In Vancouver Things To Know Before You Buy

Here are some benefits to working with an accounting professional over a bookkeeper: An accounting professional can give you a detailed sight of your business's financial state, along with methods and suggestions for making economic choices. Bookkeepers are only liable for tape-recording economic purchases. Accountants are called for to complete more education, certifications as well as work experience than bookkeepers.

It can be challenging to assess the proper time to employ an accounting expert or accountant or to identify if you need one in all. While numerous small companies work with an accountant as a consultant, you have a number of options for dealing with economic tasks. Some small service owners do their very own bookkeeping on software application their accountant advises or makes use of, giving it to the accounting professional on a weekly, regular monthly or quarterly basis for action.

It may take some history research to locate a suitable bookkeeper because, unlike accounting professionals, they are not needed to hold a specialist qualification. A strong endorsement from a relied on associate or years of experience are important variables when employing a bookkeeper. Are you still unsure if you need to hire somebody to help with your books? Right here are three instances that show it's time to employ a financial professional: If your taxes have become also complicated to take care of on your own, with numerous revenue streams, foreign financial investments, a number of reductions or other considerations, it's time to employ an accounting professional.

7 Easy Facts About Vancouver Tax Accounting Company Explained

For local business, experienced money monitoring is a vital facet of survival as well as development, so it's a good idea to deal with a monetary professional from the beginning. If you like to go it alone, consider starting with accountancy software application and keeping your books thoroughly approximately date. In this way, should you require to hire a professional down the line, they will have visibility into the total monetary background of your company.

Some resource interviews were performed for a previous variation of this article.

Cfo Company Vancouver for Beginners

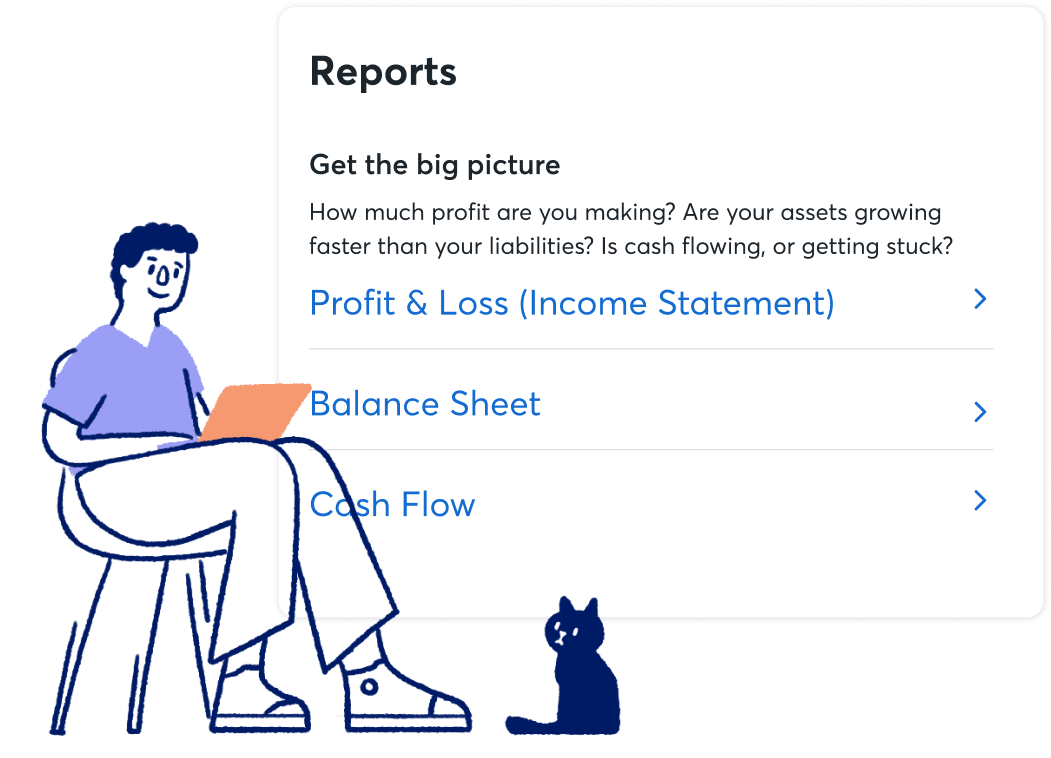

When it pertains to the ins as well as outs of taxes, accounting and also finance, nevertheless, it never ever injures to have a seasoned specialist to transform to for advice. A growing variety of accounting professionals are also dealing with points such as money circulation forecasts, invoicing as well as human resources. Ultimately, a number of them are tackling CFO-like roles.Small company proprietors can expect their accountants to assist with: Choosing business structure that's right for you is very important. It affects just how much you pay in taxes, the paperwork you require to file and also your personal obligation. If you're seeking to convert to a various business structure, it could cause tax obligation repercussions and also other complications.

Also business that are the same dimension as well as sector pay very small business accountant Vancouver different quantities for audit. These expenses do not transform into cash, they are essential for running your business.

The 9-Minute Rule for Vancouver Tax Accounting Company

The ordinary expense of accountancy solutions for small company varies for each special situation. Considering that accountants do less-involved tasks, their prices are typically less costly than accountants. Your economic solution fee depends upon the job you require to be done. The ordinary monthly audit charges for a small company will increase as you add more solutions and the jobs obtain harder.You can videotape transactions as well as process payroll making use of on the internet software. You go into quantities right into the software program, as well as the program computes total amounts for you. Sometimes, pay-roll software program for accounting professionals allows your accountant to offer pay-roll processing for you at very little additional cost. Software program remedies are available in all shapes and sizes.

The 4-Minute Rule for Outsourced Cfo Services

If you're a brand-new entrepreneur, do not forget to variable bookkeeping expenses right into your budget plan. If you're a professional owner, it could be time to re-evaluate bookkeeping costs. Management costs and accounting professional fees aren't the only accountancy costs. outsourced CFO services. You ought to additionally think about the results bookkeeping will certainly have on you as well as your time.Your ability to lead employees, serve consumers, and also choose can suffer. Your time is additionally beneficial and should be taken into consideration when looking at audit costs. The time invested in audit tasks does not create profit. The less time you spend on bookkeeping and also taxes, the more time you need to expand your service.

This is not intended as lawful guidance; to learn more, please click right here..

The 15-Second Trick For Small Business Accounting Service In Vancouver

Report this wiki page